Algobee

(crypto futures)

Take control of your day trading effortlessly.

Product Description

Supported Exchanges:

Algobee supports integration with the following cryptocurrency exchanges:

ü Bitget (Ref ID: KBB6RQ): CLICK HERE

ü Binance (Ref ID: CPA_003F0013PU): CLICK HERE

ü Bybit (Ref ID: 2AJOW): CLICK HERE

ü Gate.io (Ref ID: AVFFB1PB): CLICK HERE

ü Bitmart (Ref ID: cNBUQ4): CLICK HERE

ü Kucoin (Ref ID: rBPLQMM): CLICK HERE

1. How It Works:

Algobee is a Telegram-based cryptocurrency trading bot that connects to your account on supported exchanges via API keys. Once connected, Algobee executes trades on behalf of you based on predefined strategies and market signals.

1.1: Commands

u /settings: This command allows you to configure your bot’s parameters. We call it Master Settings because these settings will be applied universally to all tradable symbols.

For a Buy, AlgoBee places a limit buy order at a specific high of a candle—this high is determined based on the bot’s preferences.

For a Sell, it places a limit sell order at a specific low of a candle, also determined by the bot’s preference.

📌 If the limit order is not triggered and a new high (for buys) or low (for sells) is formed, the bot automatically adjust the limit order to that new level.

✅ Once the limit order is executed, the bot sets a take-profit target.

However, if the market moves against the position, the bot places a new limit order at the next strategic high or low. Once triggered, it adjusts the take-profit accordingly.

🧠 AlgoBee is ideal for users who want to build their portfolio gradually over a long period.

It is recommended to trade only one instance with AlgoBee Strategy.

Exchange: Click here to link your exchange to your bot. If no exchange is linked, None will be displayed. Otherwise, the name of the linked exchange will be shown and the balance will be updated.

Power: This option turns your strategy on or off.

QuoteSymbol: This options allows you to set the symbol with which you keep your funds in your exchange (e.i. USDT, USDC).

SizeUSDT: This option allows you to set the trade volume in USDT for each position.

TradeAlert: This option allows you to instruct your bot to send you notifications, including trade executions, increments, and exits.

⏎Restore Default: This option allows you to reset your bot master settings to the default.

The Progressive HFT Strategy is a high-frequency trading system designed to progressively increase profits 📈.

⚙️ It works by opening multiple positions as the market moves in a specific direction, based on the bot’s internal logic 🤖.

As each new position is added, the bot adjusts take-profit levels to cover all trades and lock in profits ✅.

🔁 If the market reverses, the bot places new entries at key reversal points. Once the trend confirms again, it closes all positions in profit 💰.

⚡ This strategy is best suited for fast market conditions and aims to make the most out of short-term price movements 📊.

Exchange: Click here to link your exchange to your bot. If no exchange is linked, None will be displayed. Otherwise, the name of the linked exchange will be shown and the balance will be updated.

Power: This option turns your strategy on or off.

QuoteSymbol: This options allows you to set the symbol with which you keep your funds in your exchange (e.i. USDT, USDC).

TPPerc (Take Profit Percentage): This option allows you to set your Take Profit in Percentage. It equals to the overall percentage of your account balance.

Note: If ExitTotalPNL is turned ON, TPPerc is calculated based on your overall balance (e.g., 1% of your total balance). But if ExitTotalPNL is turned OFF, then TPPerc is calculated based on your trade volume (e.g., for a trade size of 2 USDT, it is going to be TPPerc of 2 USDT).

SizeUSDT: This option allows you to set the trade volume in USDT for each position.

Aggressive: This option when turn on tells your bot to apply the most profitable options available as long as the drawdown is not greater than the MaxDD value.

TradeAlert: This option allows you to instruct your bot to send you notifications, including trade executions, increments, and exits.

⏎Restore Default: This option allows you to reset your bot master settings to the default.

u /bot_instances: This command allows you to view your bot instances, which is essentially a complete bot setup dedicated to a single symbol, referred to as an ‘Instance.’ When you create an instance, your bot generates multiple bots for the selected trading pair. These multiple bots are referred to as populations. The bot then evaluates these populations and selects the best one, ensuring that its maximum drawdown (Max DD) stays within the range you have specified. Each instance inherits the Master Settings upon creation, but you can customize the trading settings specifically for the selected symbol. To modify the instance settings, click on the Show XXX/USDT Settings keyboard below the instance. To check a single instance send check ‘the coin symbol’ example check BTC, to delete an instance reply delete to the instance. To clear all instances then reply delete to the total instances respond message

u /get_positions: This command allow you to view all current positions executed by your bot.

u /referrals: This command allows you to view your referral link, check your earned commissions and withdraw your affiliate commissions.

Note:

1. You must link a wallet for withdrawals.

2. Referral commissions are processed automatically by the bot.

3. To withdraw your commission, reply with “withdraw” to the response message of the /referrals command.

4. Withdrawals are instant and processed via the Base Network, so your linked wallet must be on the Base Mainnet. If you withdraw to the wrong address, you bear full responsibility for the transaction. Please double-check your wallet address before initiating a withdrawal, as the bot cannot reverse or recover funds sent to an incorrect address

5. During maintenance, affiliate commission withdrawals will be temporarily paused.

2. Technique:

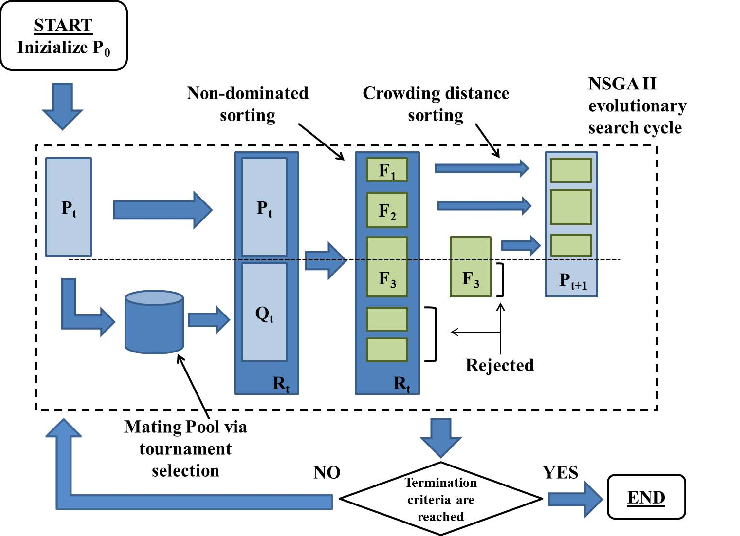

Algobee utilizes machine learning algorithms known as genetic algorithms (GA), a powerful optimization technique inspired by natural selection, to create robust trading strategies. By mimicking the process of evolution, Algobee identifies and refines optimal trading parameters for your selected trading pair.

Genetic Algorithms: A genetic algorithm is a search and optimization method that evolves solutions through selection, crossover, and mutation. In Algobee, this approach enables the creation of multiple trading strategies (populations), which evolve over time to maximize profitability and minimize drawdown.

Key Components:

- Population: A set of trading strategies, each with unique parameters (e.g., entry/exit thresholds, stop-loss levels, etc.).

- Fitness: Measures the performance of each strategy, focusing on metrics such as profit, drawdown, and risk-reward ratio.

- Selection: The best-performing strategies (with the highest fitness) are selected for reproduction.

- Crossover: Combines the parameters of selected strategies to create new ones, inheriting strengths from their “parents.”

- Mutation: Introduces random variations in parameters to explore new possibilities and prevent stagnation.

- Evolution: Over multiple generations, the population evolves, and Algobee selects the fittest strategy for live trading.

How Algobee Works:

Initialization: When you create an instance, Algobee generates an initial population of strategies tailored to your selected trading pair. Each strategy is tested on historical data to evaluate its fitness.

Evolution Process:

1. Trend Detection:

l Algobee identifies the current market trend using advanced statistical methods.

l Genetic algorithms optimize strategy parameters for each trend type (uptrend, downtrend, sideways).

2. Live Trading Rules:

l After evolving through multiple generations, the fittest strategy is deployed for live trading.

l Algobee constantly monitors market conditions and adapts parameters in real time.

Entry Rules:

1. Uptrend (Buy Signal): Optimized parameters suggest a high-probability buy entry.

l Entry triggers when the strategy identifies oversold conditions in an uptrend.

l Algobee executes a buy position.

2. Downtrend (Sell Signal):

l Optimized parameters suggest a high-probability sell entry.

l Entry triggers when the strategy identifies overbought conditions in a downtrend.

l Algobee executes a sell position.

Exit Rules:

l Positions are closed or reverse when:

1. The fitness evaluation indicates a reversal in trend.

2. The evolved parameters suggest a loss-minimizing exit.

Key Points to Note:

1. Manual Position Closure Guidelines for Parent and Offspring Strategies:

l In some cases, there will be both a parent and an offspring strategy, each operating as an independent bot trading a specific symbol. The parent strategy may hold hedged positions alongside the offspring strategy. In such scenarios, manually closing one side of the position is strictly prohibited, as it alters the bot’s intended functionality and may lead to unintended losses.

l Generally, manually closing bot positions is not recommended, as the system is fully automated. However, if you choose to close positions manually—perhaps because the net PNL is positive—you must do so in pairs. This means closing both the long and short positions of either the parent or the offspring strategy simultaneously.

2. Evolution Takes Time:

l The first few days after activation are a learning phase for Algobee. It takes up to 5 days to evolve and sync with the market, refining its parameters through real-time data.

l During this period, some losses may occur. This is part of the optimization process.

3. Ratios

- The instance-to-balance ratio is 1:100.

This means that for every 100 USDT in your balance, you only need one bot instance.Additionally, the recommended trade size for each instance is 2% of your balance, ensuring optimal risk management while maximizing trading opportunities.

4. Market Direction Prediction:

l Algobee’s genetic algorithms excel at adapting to dynamic market conditions, aiming to:

l Identify the point where markets are likely to turn bullish.

l Identify the point where markets are likely to turn bearish.

l If the prediction is incorrect, Algobee quickly re-evaluates and adjusts its strategy, reducing exposure to losses.

5. Continuous Adaptation:

l Unlike static strategies, Algobee evolves continuously, adapting to market volatility and trends.

Bot Settings:

Algobee provides customizable settings for advanced users who wish to fine-tune its parameters. However, if you are new to trading or unsure about the changes, it is highly recommended to stick to the default settings, which are optimized through genetic algorithms for general use.

Disclaimer:

Trading involves risks, and there are no guarantees of profit. Past performance is not indicative of future results.

INSTALLATION VIDEO

PRIVACY POLICY FOR ALGOBEE

Effective Date – Monday, May 12, 2025:

Welcome to AlgoBee, your trusted AI-powered trading bot. This Privacy Policy explains how we collect, use, and protect your personal information when you use our services.

When you sign up for AlgoBee, we may collect the following personal data:

- Username – to identify your account.

- Email address – to send updates, alerts, and support communication.

- Country – to comply with regional regulations and customize your experience.

We do not collect sensitive financial data unless explicitly required and consented to.

We use this data to:

- Create and manage your AlgoBee account.

- Send important updates, alerts, and customer support messages.

- Personalize your experience based on your location.

- Comply with legal obligations, including anti-money laundering laws if applicable.

We collect and process your data based on:

- Your Consent – when you sign up and accept this privacy policy.

- Legitimate Interest – to improve and operate AlgoBee effectively.

- Legal Obligation – where required by law.

- Access – Request a copy of your data.

- Rectify – Update incorrect or incomplete information.

- Delete – Ask us to delete your data (“right to be forgotten”).

- Restrict Processing – Limit how we use your data.

- Object – Withdraw consent or object to specific uses.

- Data Portability – Request your data in a machine-readable format.

To exercise any of these rights, contact us at tom@fluronix.com

Your data is securely stored on [e.g., AWS, DigitalOcean] servers with strict access controls. We use encryption, firewalls, and best security practices to prevent unauthorized access.

We retain your data only as long as needed for the purposes stated, or as required by law.

We may use third-party tools for analytics, messaging, or hosting. These providers are bound by GDPR and only access data as needed to provide their services.

If applicable, our platform may use cookies to improve functionality. You will be informed and allowed to opt-in where required.